I rely on my expense tracker in Google Sheets. It’s how I evaluate my finances, track financial goals, and monitor monthly bills. Because I believe budgeting shouldn’t require expensive apps, I created a free template that handles the math for you.

Below, you can download my template immediately, or read on to learn how to build your own from scratch.

Get the Free Expense Tracker

Skip the setup and start tracking your budget today.

DOWNLOAD TEMPLATE (GOOGLE SHEETS)

Note: Clicking the link will automatically prompt you to “Make a Copy” to your personal Google Drive.

What is an Expense Tracker?

An expense tracker is a tool that records your expenditures and income. Unlike a standard expense report (which usually documents business costs for reimbursement), a personal expense tracker visualizes your spending habits by category. It helps you identify which expenses are necessary and which are frivolous.

Option 1: The Easy Way (Use My Template)

If you downloaded the template above, here is how to use it.

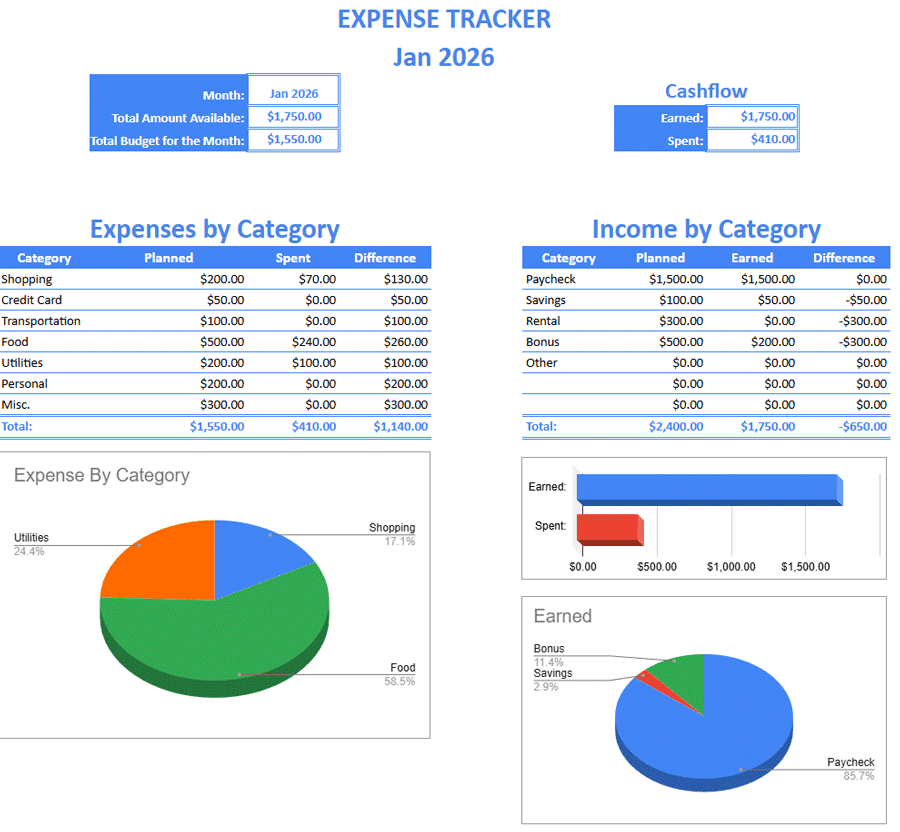

The spreadsheet uses a tab-based system. You will see a Summary tab and a Transactions tab.

- Summary Tab: This is your dashboard. Enter your “Starting Balance” at the top. Customize your categories (e.g., Rent, Groceries, Dining Out) in the category column.

- Transactions Tab: This is your logbook. Every time you spend money, enter the date, amount, description, and select the category from the dropdown menu.

The charts on the Summary tab will automatically update as you enter data.

Note that you’ll need to log in with your Google account to get this template. You’ll also need an internet connection to make your copy. Once you have it, you can make it available offline, and the calculations will update automatically.

Looking for more data analysis in your life? Try this spreadsheet alongside these free budget templates.

Option 2: The DIY Way (Build From Scratch)

If you prefer to build your own tool to understand exactly how the formulas work, follow this tutorial. We will build a dynamic tracker where monthly tabs feed into a master dashboard.

Step 1: Set Up Your Tabs

Create a new Google Sheet. You will need two tabs initially:

- Rename Sheet1 to Expense / Budget Summary.

- Create a new sheet and rename it Jan 2026 (or the current month).

- Input your first data, even if it’s just sample data.

Crucial Note: The naming convention of your monthly tabs matters because we will use formulas to reference them later.

Step 2: Create the Transactions Log

Go to your Jan 2026 tab. Create the following columns:

- Date

- Amount (Format as Currency)

- Description

- Category

Step 3: Create the Dashboard Layout

Go to your Expense / Budget Summary tab. You will want to create tables for “Income by Category” and “Expenses by Category.” This is your at-a-glance overview. It’s my favorite part of the tracker.

Pro Tip: Create a cell (e.g., C3) where you type the month you want to view (e.g., “Jan 2026”). We will use this cell to tell the formulas which tab to look at.

Step 4: The Dynamic Formulas (The Secret Sauce)

This is where most people get stuck. We want our dashboard to pull data from the “Jan 2026” tab without us having to rewrite formulas every month. We do this using the INDIRECT function.

Formula for Total Cash Flow

To sum up all money earned from Column J in your monthly tab, paste this formula into your summary cell:

=SUM(INDIRECT(TEXT($C$3,"mmm yyyy")&"!J3:J"))

What this does: It looks at cell C3 (the date), converts it to text (e.g., “Jan 2026”), adds an exclamation point (to make it a sheet reference), and looks at Column J in that specific sheet.

Formula for Category Spending

To calculate how much you spent on “Groceries” (assuming “Groceries” is written in cell A11 of your dashboard), use this SUMIF formula:

=SUMIF(INDIRECT(TEXT($C$3,"mmm yyyy")&"!E3:E"),A11,INDIRECT(TEXT($C$3,"mmm yyyy")&"!D3:D"))

This checks the Category column in your monthly sheet (!E3:E) and sums the Amount column (!D3:D) only if it matches “Groceries.”

Step 5: Visualizing the Data

Numbers are great, but visuals help you spot trends.

Create a Spending Pie Chart

- Highlight your “Actual Spent” column and your “Category” column in the Summary tab.

- Go to Insert > Chart.

- Select Pie Chart.

- In the editor, ensure the Label is your Category and the Value is your Spent amount.

Step 6: Data Validation (Preventing Errors)

To ensure you don’t accidentally type “Food” in one row and “Groceries” in another (which breaks your formulas), use dropdowns.

- Go to your Transactions tab.

- Highlight the Category column.

- Go to Data > Data Validation.

- Select List from a Range.

- Select the list of categories you wrote on your Summary page.

Now, you can only select valid categories from a dropdown menu.

Common Questions about Expense Tracking

How do I track business expenses vs. personal?

I recommend adding a “Tag” column to your transaction sheet. You can create a dropdown with “Personal” and “Business.” You can then use a SUMIF formula to calculate total business expenses separately for tax purposes.

Can I connect my bank account?

Google Sheets does not connect to bank accounts natively. However, you can use third-party add-ons (like Tiller) or Google Apps Script to import CSV files from your bank. That’s one way to reduce human error and get real-time updates on any device.

How do I track mileage?

While you can add a tab here, mileage is often better tracked in a dedicated log. You can check out my mileage log template which can be linked to this workbook using the IMPORTRANGE function.

Conclusion

Whether you choose the ready-made template or build your own from scratch, the most important step is consistency. A tracker only works if you use it.

Start by logging your transactions once a week. It’s the best way to gain control over your financial future. When used regularly, this expense tracker is a super easy addition to any monthly budget template.